In today’s fast-paced financial landscape, your credit score isn’t just a number—it’s a living signal that can affect the interest you pay, the loans you qualify for, and the way lenders perceive your financial reliability. Monthly credit score checks have become a practical habit for savvy consumers who want to head off surprises and stay on track with goals like buying a home, financing a car, or starting a new business. Rather than waiting for an annual statement, frequent checks give you real-time insight into how daily actions influence your score and what steps you can take to protect it.

One core reason to monitor your score regularly is accuracy. Financial reports can contain errors, fraudulent activity, or outdated information that drags your score down unfairly. By checking online every month, you spot mistakes quickly and can dispute them before they cause long-term damage. This is part of the broader idea behind solid reasons why you should do a credit score check online every month — not just to see a number, but to verify the data behind the number. When you verify accuracy, you protect not only your current borrowing power but also your future capacity to borrow at favorable terms.

Beyond Accuracy: Catching Fraud Before It Escalates

Monthly checks help detect identity fraud early. Fraudsters often use small, incremental activity that can slip past annual reviews. By reviewing your reports monthly, you can catch unfamiliar inquiries, new accounts, or unusual debt patterns while you still have time to respond. Early intervention can stop damage from growing and reduce the risk of longer-term credit damage. Beyond fraud, regular monitoring also helps you observe how lifestyle changes—such as a new job, a reduction in debt, or a sudden medical expense—affect your score and what adjustments you should make to optimize it. Treat these checks as a routine investment in financial resilience rather than a one-off task.

Practical Ways to Monitor Your Score Safely Online

To make monthly checks routine and secure, follow these best practices:

- Use official credit bureaus or reputable financial apps that clearly state data sources and update frequencies.

- Protect your accounts with strong passwords and enable two-factor authentication where available.

- Set a monthly reminder and schedule a fixed time to review your score and the underlying factors driving changes.

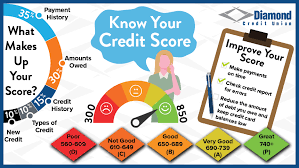

- Understand the five factors that commonly influence your score: payment history, amounts owed (credit utilization), length of credit history, new credit, and credit mix.

Consistency is key. Even small monthly shifts in your score can reveal patterns—such as how high credit utilization on one card temporarily drags your overall score, or how timely payments produce noticeable gains over time. By making a habit of checking, you gain clarity and control over your financial trajectory rather than letting external events dictate your borrowing power.

For a broader set of personal-finance insights and tools, visit the Marketinic homepage.

If you’re serious about maintaining a healthy credit profile, commit to a monthly cadence, educate yourself on the factors that move your score, and actively dispute any inaccuracies you find. The practice of regular monitoring equips you with the knowledge to optimize your borrowing terms, save money on interest, and pursue your financial goals with confidence.