In business finance, two terms often get used interchangeably, but they mean different things. When founders and managers plan budgets, pitch investors, or evaluate performance, clarity about top-line metrics matters. For many readers, the question often comes down to is revenue the same as sales and how each metric should be used in decision making.

Understanding revenue

Revenue represents the total income a company earns from its primary activities and other sources during a given period. It appears on the top line of the income statement and serves as a broad measure of scale. Depending on your accounting framework, revenue can include returns, discounts, and taxes, or it may exclude them. In accrual accounting, revenue is generally recognized when the performance obligation is satisfied, not just when cash is received. This distinction helps investors compare companies with different payment terms or business models.

Understanding sales

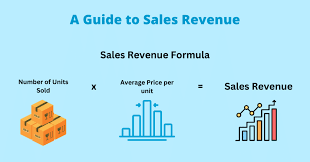

Sales usually refers to the revenue generated from selling goods or services to customers through core business operations. In many contexts, “sales” is a subset of revenue and is frequently tracked by product line, channel, or geography. Some businesses also use “sales” to describe unit counts or cash receipts from customer transactions, which can differ from revenue if there are refunds, rebates, or non-operating income layered into the period. The nuance matters when you analyze performance and forecast cash flow.

Is revenue the same as sales?

Is revenue the same as sales? The concise answer is no, in general. However, in simple retail scenarios, people may use the terms interchangeably. The crucial distinction is scope: sales focuses on the transactional inflow from customers, while revenue includes all income streams the business earns during a period. When you present financials to investors or lenders, clearly define both terms to avoid confusion. is revenue the same as sales is a common search phrase for those learning to interpret income statements.

Why the distinction matters

The terminology you use shapes how stakeholders interpret growth, profitability, and risk. A company could report rising sales while revenue growth stagnates if it relies on heavy discounts, returns, or changes in pricing terms. Conversely, revenue might expand due to recurring licensing, subscription fees, or services that aren’t captured in a single “sales” figure. For strategic planning, investors, lenders, and executives benefit from seeing both the macro top-line trend and a granular breakdown of how that top line is earned.

Practical tips for business planning

- Always define revenue clearly in internal reports and investor decks to prevent ambiguity.

- Track revenue by segment (product, service, channel) in addition to total revenue, so you can pinpoint drivers of growth.

- Separate sales metrics from other revenue streams (royalties, interest, licensing) when presenting results.

- Clarify revenue recognition policies (timing, performance obligations) to ensure consistent reporting across periods.

- Use both top-line metrics and profitability measures (gross margin, operating margin) to assess true business health.

As you refine your financial reporting, consider a broader view of top-line performance and cash flow implications. Understanding the distinction between revenue and sales helps you communicate more effectively with stakeholders and build stronger forecasts. For more insights on finance, entrepreneurship, and market strategy, explore resources from BusInvesty.